World’s leading 4G LTE Broadband Operator, SK Telecom just a while ago announced new data promotions to its existing 3G-4G users on low data plans. This would impact 4.1 mn of its 3G/4G subscribers and 5 mn handsets on family bundled plans. These would account for 23- 29% of its 3G/4G subscribers. Other offerings introduced include data discounts to late night users, unlimited data gifts/VOD contents sharing among family members, and new low 3G/LTE price plan of W19,000 as the company seeks to retain its existing low ARPU customers and entice them to start spending data, while minimising any actual negative earnings impact.

World’s leading 4G LTE Broadband Operator, SK Telecom just a while ago announced new data promotions to its existing 3G-4G users on low data plans. This would impact 4.1 mn of its 3G/4G subscribers and 5 mn handsets on family bundled plans. These would account for 23- 29% of its 3G/4G subscribers. Other offerings introduced include data discounts to late night users, unlimited data gifts/VOD contents sharing among family members, and new low 3G/LTE price plan of W19,000 as the company seeks to retain its existing low ARPU customers and entice them to start spending data, while minimising any actual negative earnings impact.

60% new SKT LTE subscriptions are opting for LTE 69 packages given its unlimited voice/+5G monthly data, and higher handset subsidies, we expect these latest moves to potentially slow the near term blended APRU growth as the lower APRU users may now find less reason to move to higher data packages.

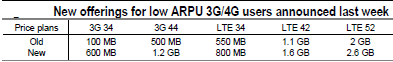

We expect SKT to maintain its dominant market share given the structural tailwinds of the LTE market as the company further shifts its marketing focus on customer retention. The following chart shows the comparisons of new Vs Old SK Telecom 3G / 4G Plans