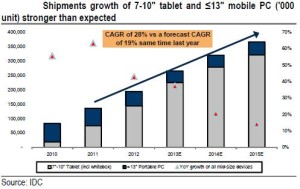

Over the past 12 months, unit shipments for mid-sized devices have been stronger than street’s expectations with firms such as IDC now forecasting a 2011-2015 CAGR of 28% for the category (vs. a forecast CAGR of 19% same time last year), a number closer to our last year’s forecast for a 30% growth rate. However, almost the entire upside has come about from Android-based 7-8″ tablets with Windows-based devices being significantly below expectations.

Over the past 12 months, unit shipments for mid-sized devices have been stronger than street’s expectations with firms such as IDC now forecasting a 2011-2015 CAGR of 28% for the category (vs. a forecast CAGR of 19% same time last year), a number closer to our last year’s forecast for a 30% growth rate. However, almost the entire upside has come about from Android-based 7-8″ tablets with Windows-based devices being significantly below expectations.

A combination of lower price points and better portability / ease of use are driving a shift in consumer preference towards these smaller tablets. As a result of this shift, combined units sales of all 8″+ tablets and consumer notebooks are likely to fall on a YoY basis in 2013 and that decline will probably be in double digits if one only considers 10″ and above tablets plus consumer notebooks. With declining sales of almost all 10″+ screen sized devices in 2013 and an aging installed base of notebooks, we believe there is a developing latent demand for larger-screen sized products.

The market consensus is for a continued weakness in both the 10″ tablets category as well as the mobile PCs category going into 2014 as well. If market expectations prove to be true, by next year, the installed base of all such devices will start to fall (current installed base of mobile PCs is quite old) implying that over the coming years there are likely to be several households around the world where consumers would entirely be dependent on sub-10″ screen-sized mobile devices for all their content creation / consumption work – a conclusion that we find hard to agree with.

What about Microsoft & Intel ?

Wintel camp still has an opportunity to capitalize on its lead in the space by providing devices at the correct price points and with functionality that meets consumer requirements. If, however, Wintel fails in its attempt to appeal to the consumer over the next product cycle starting in 4Q13, we believe, the Android and the Apple eco-systems would continue to narrow the gap both in terms of hardware.