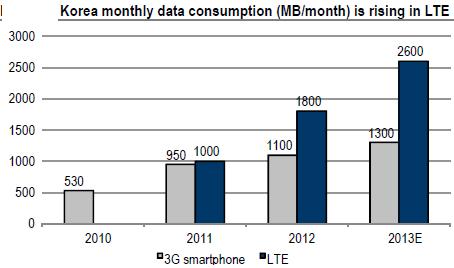

4G LTE has led to a big jump in data consumption behaviour as shown in Figure 3, with Korea leading the global curve with ~1 GB/month and ~1.8 GB/month of data usage in 2011 & 2012, respectively, versus the global average of 342 MB/month and 1.3 GB/month. The Cisco Visual Networking Index is forecasting a 30.8% CAGR for 2012-17 in average global traffic per device with smartphones accounting for ~70% of data traffic by 2017.

4G LTE has led to a big jump in data consumption behaviour as shown in Figure 3, with Korea leading the global curve with ~1 GB/month and ~1.8 GB/month of data usage in 2011 & 2012, respectively, versus the global average of 342 MB/month and 1.3 GB/month. The Cisco Visual Networking Index is forecasting a 30.8% CAGR for 2012-17 in average global traffic per device with smartphones accounting for ~70% of data traffic by 2017.

LTE ARPU lies in its tiered data plans. Unlike Korea’s 3G data planning went unlimited on August 2010 due to severe competition among the operators. This not only capped the upside growth of ARPU from potential data increases, but also led to even steeper absolute ARPU competition. It is difficult to envision a fundamental change in such competitive behavior this time. Interestingly, many of the markets that introduced 3G after Korea managed to keep their data plans tiered and sustain their earnings growth. We see favourable tailwinds in 4G LTE battleground, including a lack of 5G upgrade path, rising data consumption trends and longer handset replacement cycles.