The enrollment in the ambitious Indian Government’s Unique Identity Authority of India – UIDAI a.k.a Aadhar Card has touched 490Mn [little short of 500 Mn / 50 Cr] and is all set to reach the 600m targeted by Mar’14. As we have highlighted before, UID aims to lower fraud risks and its applications such as DBT help reduce government expenditure leakages; far outweighing its US$3bn cost.

The enrollment in the ambitious Indian Government’s Unique Identity Authority of India – UIDAI a.k.a Aadhar Card has touched 490Mn [little short of 500 Mn / 50 Cr] and is all set to reach the 600m targeted by Mar’14. As we have highlighted before, UID aims to lower fraud risks and its applications such as DBT help reduce government expenditure leakages; far outweighing its US$3bn cost.

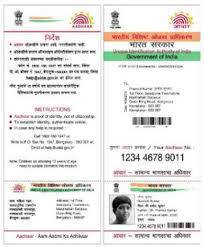

The benefits of giving every Indian a unique identity (UID) through the biometrics based UID number which is almost impossible to duplicate. The US$3-3.5bn project has already seen 488m enrollments. The number is rising by about 25m/month with rising acceptance of the same across India. Multiple efficiency improving applications can be built on UID. Direct benefit transfer (DBT) is one of the most important applications. Others potential include even person to person payment via a mobile device.

Financial linking has picked up with UIDAI Card

Thus far 37m bank accounts have been linked to UID and the target is to reach a 100m by Dec-14. This will ensure better facilitation of Direct Benefit Transfer (DBT) scheme of the government, further creating demand pull for the UID scheme.

Meanwhile use of UID for achieving greater financial inclusion has made steady progress. Our earlier meetings with UIDAI suggested that the KYC diligence for UID (eKYC) is good enough to open a bank account as per RBI. All other financial regulators like the SEBI, IRDA and PFRDA have agreed with the RBI on this.

DBT for LPG being expanded aggressively

The DBT scheme, building on UID database, is expected to usher in multiple positives, key being deficit reduction. An estimated 15% duplicate accounts exist in LPG which are now getting eliminated thanks to the UID. This has also kept the LPG consumption in check by curbing leakages.