Netflix is one of the pioneers in stimulating on-line subscription video on demand (SVoD) consumption in the United States. The recent launch of Netflix services across 130 new countries (including Singapore, Hong Kong, and Taiwan) has generated interest amongst investors on the potential impact of Netflix on traditional video ecosystem.

Netflix is one of the pioneers in stimulating on-line subscription video on demand (SVoD) consumption in the United States. The recent launch of Netflix services across 130 new countries (including Singapore, Hong Kong, and Taiwan) has generated interest amongst investors on the potential impact of Netflix on traditional video ecosystem.

Broadband infrastructure is critical for delivery of quality OTT services online. Netflix states that a minimum speed of 3 Mbps is needed to watch SD quality videos, 5 Mbps is needed for HD quality and 25 Mbps for ultra HD services. Overall broadband infrastructure is good across the three developed Asian regions (Singapore, Hong Kong, and Taiwan), with Singapore and Hong Kong more developed than Taiwan. Singapore and Hong Kong have residential broadband penetration of c.102% and c.84%, respectively, vs c.67% for Taiwan. Also, the average download speed in Hong Kong and Singapore is higher than experienced in Taiwan. We scale Singapore and Hong Kong higher on this parameter compared to Taiwan.

Affordability of OTT services is also a relevant metrics, in our view, to judge markets more susceptible to emergence of OTT services. We calculate the ratio of price of Netflix services relative to price of existing pay TV services for Hong Kong, Singapore and Taiwan to ascertain regions more vulnerable on this parameter. Higher percentage implies low affordability for OTT services as the average pricing of pay TV services is quite low in that particular region. Based on our analysis, Singapore looks more vulnerable on this parameter as OTT price percentage of pay TV ARPU is low (c.23%) amongst the three regions in discussion.

One of the metrics used by some of the market participants is the existing OTT ecosystem. If the existing OTT ecosystem is already developed, then the launch of new OTT services such as Netflix will have minimal impact on the competitive dynamics for pay TV operators. Hong Kong has the most evolved OTT ecosystem amongst the three regions in our discussions. Hong Kong pay TV market saw the entry of a new player Letv in 2015. Letv is one of the leading online entertainment portals in China and launched its OTT services in HK with the acquisition of English Premier League (EPL) rights for Hong Kong for the next three seasons.

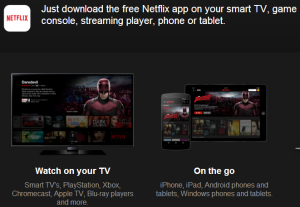

That said, we believe the Netflix launch carries substance, irrespective of the existing OTT ecosystem, given the quality of its content (Netflix Original series) and superior technology platform. We believe Netflix’s launch will further galvanise the OTT ecosystem in Asia and its investment in local content is likely to lead to further improvement in content offering.