There appears to be a pervasive belief that The Next New Thing from Apple will have to be a hardware device that will change the story just as the iPod, iPhone and iPad did when they were launched, particularly since it is becoming more apparent that Apple’s hardware has become less differentiated relative to the competition. After all, the platform (iTunes content, apps, etc.) provides switching costs and without a robust source of switching costs, any new hardware category is unlikely to remain differentiated for long. Just as the iPod was unlikely to remain dominant without the iTunes music store, and the iPhone changed the mobile handset market by leveraging bite-sized apps, any new hardware category needs to leverage and enhance differentiated functionality on Apple’s platform.

There appears to be a pervasive belief that The Next New Thing from Apple will have to be a hardware device that will change the story just as the iPod, iPhone and iPad did when they were launched, particularly since it is becoming more apparent that Apple’s hardware has become less differentiated relative to the competition. After all, the platform (iTunes content, apps, etc.) provides switching costs and without a robust source of switching costs, any new hardware category is unlikely to remain differentiated for long. Just as the iPod was unlikely to remain dominant without the iTunes music store, and the iPhone changed the mobile handset market by leveraging bite-sized apps, any new hardware category needs to leverage and enhance differentiated functionality on Apple’s platform.

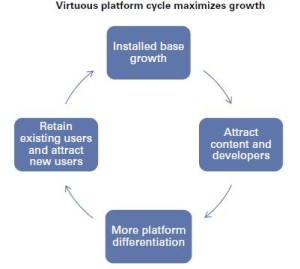

Furthermore, with streaming music services, continued growth in free apps, and a relentless pace of Android ecosystem innovations from Google, there is a risk that historical sources of switching costs and user loyalty become less relevant, making Apple increasingly exposed to installed base erosion and hardware commoditization. As such, we believe Apple needs not only to enhance the differentiation of its existing sources of switching costs (e.g., iTunes, the App Store) but also to make sure its platform remains relevant in emerging categories such as mobile commerce and wearables broader Internet of Things category).

Apple’s evolution as a company has been partially shaped by this process over the past decade: (1) the iPod platform was intricately dependent upon media content, with iTunes representing the primary delivery

mechanism for this content; (2) the smartphone subsumed this functionality, and Apple was able to link-and-leverage its iTunes dominance to give the iPhone a head start in this burgeoning market opportunity; (3) with the emergence of the App Store and bite-sized, mobile-centric apps, iPhones began to capture the personal compute functionality once reserved for Macs and PCs; and (4) the iPad took this to the next level, abruptly changing

the personal computing industry landscape.

Given Apple’s long history of innovation and its tremendous R&D resources, we believe it is reasonable to assume that Apple will successfully enter new hardware categories in 2014 and 2015, and these should be additive to current revenue and earnings expectations.