The next leg of growth will be supported by emerging markets. This will drive a shift towards commoditisation and standardisation, facilitated by lower barriers to entry. With the whitebox market (no-brand) accounting for c21% of handset revenues in 2015 (up 2ppts from 2013), third place after Samsung’s 31% share and Apple’s 24%.

The next leg of growth will be supported by emerging markets. This will drive a shift towards commoditisation and standardisation, facilitated by lower barriers to entry. With the whitebox market (no-brand) accounting for c21% of handset revenues in 2015 (up 2ppts from 2013), third place after Samsung’s 31% share and Apple’s 24%.

Analysts forecast for whitebox smartphones by 18%/40% for 2013/14 and also increased Average Selling Price [ASP] forecast by 19%/40%. We expect feature phones to account for only 4% of handset market revenues in 2015 with feature phones, driving 29% and 23% revenue declines in the next two years. Analysts estimates of global handset revenues for 2013/14 by 1%/5% as we expect stronger smartphone sales to more than offset weaker feature phone sales.

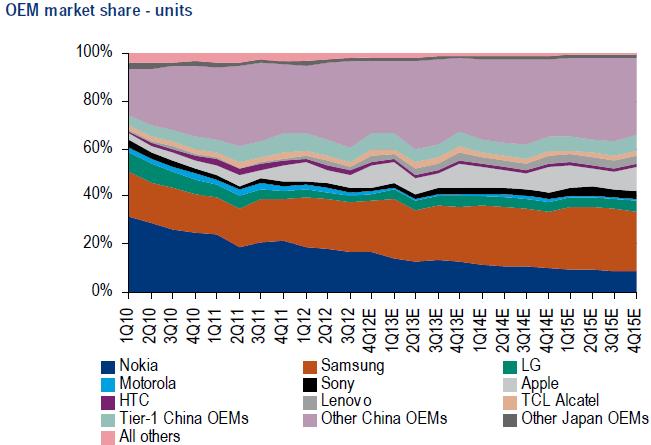

The following Chart Shows the OEM market share – units for Motorola Sony Apple HTC Lenovo TCL Alcatel Tier-1 China OEMs Other China OEMs.

MediaTek (leading smartphone platform supplier to emerging markets vendors) will benefit from commoditisation, Avago (proprietary filters address 4G technology challenges) from increasing complexity, whilst ARM (lowers barriers to entry, benefits from increasing smartphone software complexity) will benefit from both.

Android remains the most popular operating system, capturing c80% share. Apple has also stabilised at around 13%, whilst Windows remains a distant number 3 (c3%). We believe the expected growth in emerging markets will favour the Android ecosystem, given the availability of low end smartphones that are offered at low price levels.