Many Mobile apps now offer either voice messaging (Wechat) or straight VoIP functionality (Skype, Viber, Line). While it is difficult to prove a direct linkage between usage of these apps and usage/revenue trends within the traditional telcos, there is at least anecdotal evidence that, on average, rising 3G / 4G penetration rates are usually associated with falling voice minutes of use.

Many Mobile apps now offer either voice messaging (Wechat) or straight VoIP functionality (Skype, Viber, Line). While it is difficult to prove a direct linkage between usage of these apps and usage/revenue trends within the traditional telcos, there is at least anecdotal evidence that, on average, rising 3G / 4G penetration rates are usually associated with falling voice minutes of use.

We do not attempt to prove that messaging apps are cannibalizing voice. Instead, we attempt to quantify the cost savings to users (and therefore the voice revenue risk to operators) were subscribers to move their current voice usage over to a VoIP data based pricing model.

Compression ratios for the various CODECs used by VoIP providers vary, but we understand the most frequently used is the G.729 CODEC. Adjusting a minute of voice into a data equivalent results in the computation shown below. We take 500 KB/min as the base case for this analysis.

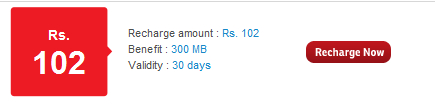

Airtel for the quarter ending Dec-2013 reported Monthly ARPU of Rs 193 on 437 Minutes of Usage / Subscriber / Month. So 437 Minutes of Voice Calls converted to Data mean just 218.5 MB of 3G Data. Airtel 3G Data Plan of 300MB costs just Rs 102.

Now if Airtel user were to use only 3G Plans for Voice / Data Communication then he would get his 437 Minutes of Usage for Voice plus an additional 81 MB for Watsapp and other messaging equivalent to SMS at just Rs 102 a 47% discount to his regular ARPU of Rs 193.

The above illustration is in ideal case [All 3G /4G networks with SmartPhones] but with below average 3G Network penetration coupled with problems of tower transition during mobility on VoIP calls will restrict full replacement in the short to medium term.