Mobile Data growth has slowed down meaningfully for operators with data ARPU’s flattening out over the past 3 quarters despite the massive rollout of services from operators. While this could have been palatable if the base were high enough, such a slowdown on low data volumes overall is a worrying trend. We believe while realization decline is necessary for increasing usage, education of users and need creation for internet use would be the key to pushing growth of data usage going forward.

ott-apps-voice-calls

Xiaomi MiTalk 2015 App to Have Forum & Shopping

Xiaomi recently released MiTalk 2015, the new version of its IM app, MiTalk (or MiLiao in Chinese). MiTalk 2015 has incorporated Xiaomi Forum and an online shopping center, allowing “MiFen” (fans of Xiaomi) to interact with each other more easily, and purchase various Xiaomi products.

Xiaomi recently released MiTalk 2015, the new version of its IM app, MiTalk (or MiLiao in Chinese). MiTalk 2015 has incorporated Xiaomi Forum and an online shopping center, allowing “MiFen” (fans of Xiaomi) to interact with each other more easily, and purchase various Xiaomi products.

Xiaomi has in addition integrated Chinese music streaming service XiaMi Music, and Microsoft chatbot Xiaobing, by cooperating with these outside companies. MiTalk has also added a basic location-based service, allowing users to find

How 95% Pre-Paid Users with Unbundled Packages Will Deter Airtel / Vodafone/ Idea ?

The A-Vo-Id [Airtel, Vodafone, Idea Cellular] Telecom Operator Lobby Control over 2/3rd of the Indian Telecom Market. They have ~95% of their subscribers on the pre-paid platform and never did they make any effort to convert them to post-paid. Never did you see them offering Bundled Packages [SmartPhones,Unlimited Voice, SMS and 3G Data] even in post-paid segment. Reliance Communications was the only exception in this regard which offered iPhone and Unlimited Calling Pack.

The A-Vo-Id [Airtel, Vodafone, Idea Cellular] Telecom Operator Lobby Control over 2/3rd of the Indian Telecom Market. They have ~95% of their subscribers on the pre-paid platform and never did they make any effort to convert them to post-paid. Never did you see them offering Bundled Packages [SmartPhones,Unlimited Voice, SMS and 3G Data] even in post-paid segment. Reliance Communications was the only exception in this regard which offered iPhone and Unlimited Calling Pack.

To date, A-Vo-Id operators focus has been on cannibalisation of SMS revenues by messaging apps (WhatsApp, Viber, WeChat, etc). Clearly, the advent of OTT voice adds an additional potential threat. At first glance, the amount of revenue exposed to

Killer App: OTT Voice Can Cannibalize Telco Revenues in Long Term

In the Global telecom industry, only the Indian market was able to generate double-digit YoY revenue growth, driven by both a recovery in voice Revenue per Minute (RPM) as the competitive environment among the players improved, and an additional kicker from data growth—in other words, both growth engines were still working.

In the Global telecom industry, only the Indian market was able to generate double-digit YoY revenue growth, driven by both a recovery in voice Revenue per Minute (RPM) as the competitive environment among the players improved, and an additional kicker from data growth—in other words, both growth engines were still working.

From a revenue perspective, at least for the time being, the advent of smartphones has created an additional growth driver for the sector, in the form of data revenues generated. Thus, to date in the region, the amount of SMS and voice revenue cannibalised by OTT mobile messenger applications, such as WhatsApp, WeChat and LINE, has been more than offset by the data revenue generated.

OTT voice a further cannibalisation threat

Three things have changed over the last 6-12 months that in our view

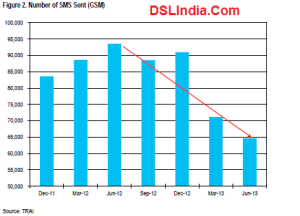

OTT Apps Lead to Massive Decline in SMS Usage

Over-the-Top (OTT) services are web-based (potentially cheaper) ways of communicating that bypass traditional voice & SMS services. TRAI data shows that SMS has already started to feel the impact from online messaging apps such as WhatsApp, and SMS’ contribution to industry rev has already declined (3%; Jun13). The expected further reduction, however, should be more than offset by data pickup (~10% of rev for Bharti/Idea), while voice revenue should remain relatively immune.

Over-the-Top (OTT) services are web-based (potentially cheaper) ways of communicating that bypass traditional voice & SMS services. TRAI data shows that SMS has already started to feel the impact from online messaging apps such as WhatsApp, and SMS’ contribution to industry rev has already declined (3%; Jun13). The expected further reduction, however, should be more than offset by data pickup (~10% of rev for Bharti/Idea), while voice revenue should remain relatively immune.

TRAI data highlights that SMS as % of rev (GSM)