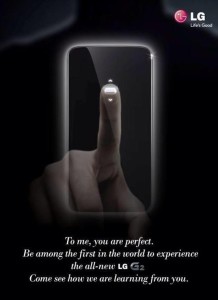

Mobile World Congress (MWC) 2014, the mobile industry’s largest annual event took place in Barcelona. Several flagship models were launched, including Samsung’s Galaxy S5, Sony Xperia Z2, and LG’s G2 Pro, with this year’s releases focusing on incremental improvements in user experience and hardware specifications, but fewer gimmicks or breakthroughs to accelerate high-end replacements. Samsung’s innovations improved on design (dust/waterproof/colours/icons, camera upgrades, processing and connectivity and better fitness / health tools while Sony made a more modest upgrade from its

android-smartphones

Why Low Priced SmartPhones Key for 3G Data Uptake in India ?

One of the key drivers for the Indian data growth story will be the availability of low-cost smartphones. We understand that c18m smartphones were sold last year in India and c25-30m smartphones are expected to be sold this year.

One of the key drivers for the Indian data growth story will be the availability of low-cost smartphones. We understand that c18m smartphones were sold last year in India and c25-30m smartphones are expected to be sold this year.

There has been significant progress already made, we believe the critical milestone will be when major brands such as Samsung, Micromax, HTC and Nokia are able to launch fully functional smartphones in the USD50 range. At present average price range in the branded smartphone segment is between USD175-500. We do believe that over the next 2- 3 years, India will be a market for refurbished whitebox smartphones as well.

One of the interesting moving

SlowDown at the Top End of SmartPhone – iPhone / Galaxy

In the past three years, high-end smartphone has been one of the biggest growth drivers for the semiconductor industry given robust unit growth and substantial semi content increase. However, a perceived lack of innovation (e.g. iPhone 5, Galaxy S4) and delays in purchases have resulted in a sharp slowdown of high-end smartphone demand in 2013. Both iPhone 5 and GS4 turned out to be major disappointments. Given Apple and Samsung together account for more than 3/4th of the total high-end smartphone market, it’s a clear sign that high-end demand is slowing down.

In the past three years, high-end smartphone has been one of the biggest growth drivers for the semiconductor industry given robust unit growth and substantial semi content increase. However, a perceived lack of innovation (e.g. iPhone 5, Galaxy S4) and delays in purchases have resulted in a sharp slowdown of high-end smartphone demand in 2013. Both iPhone 5 and GS4 turned out to be major disappointments. Given Apple and Samsung together account for more than 3/4th of the total high-end smartphone market, it’s a clear sign that high-end demand is slowing down.

The biggest culprit is apparently Apple, as we expect Apple’s high-end smartphone shipments to decline Y/Y in 2013 (we defined Apple’s high-end model as all the iPhones except for iPhone 4, but we do

Which Component Makers Benefit the Most from SmartPhone Boom ?

We believe smartphone makers cannot compromise on the display, processor and memory for high-end smartphones as they are critical components that affect user experience. There is also a limited supplier base for these components and tight supply issues (memory), which would make it difficult for smartphone makers to exert pricing pressure on these critical components.

We believe smartphone makers cannot compromise on the display, processor and memory for high-end smartphones as they are critical components that affect user experience. There is also a limited supplier base for these components and tight supply issues (memory), which would make it difficult for smartphone makers to exert pricing pressure on these critical components.

Display makers and lens module makers set to benefit

The key to hardware upgrades will likely be the display, as a direct user interface, followed by camera. We expect the smartphone screen resolution to move up from HD (1280×720) in 2012 to FHD (1920×1080) in 2013 and QHD (2560×1440) in 2014. The larger and higher resolution display comes at a higher cost, as does

HTC Caught on Wrong Foot as SmartPhne Market Shifts Focus to Low / Mid End Phones

HTC is caught on the wrong foot due to the decelerating growth of the high-end smartphone market and HTC’s weak position in the mid-low-end market. HTC is still facing structural challenges from smartphone demand polarization and commodization. Competition could be more intense when high-end makers put more emphasis on mid/low-end products, and low-end makers seek for product upgrades.

HTC is caught on the wrong foot due to the decelerating growth of the high-end smartphone market and HTC’s weak position in the mid-low-end market. HTC is still facing structural challenges from smartphone demand polarization and commodization. Competition could be more intense when high-end makers put more emphasis on mid/low-end products, and low-end makers seek for product upgrades.

HTC’s over-concentration on the new One model (other models are weaker than expected in terms of shipments) could cause high earnings risk for HTC. Now we believe that the risk could come earlier than expected as – high-end smartphone growth is decelerating recently, which will put HTC in a weak position as its product mix highly

Will Google Launch High End Android SmartPhone using Motorola Mobility ?

Purchasing Motorola in May 2012 for $9.5bn ex-cash was confusing to many of us. Since then, Google has rationalized the business (sale of Motorola Home, divestiture of manufacturing operations and layoffs) and the net cost after asset sales and tax benefits has declined to an estimated $6-7bn.

Purchasing Motorola in May 2012 for $9.5bn ex-cash was confusing to many of us. Since then, Google has rationalized the business (sale of Motorola Home, divestiture of manufacturing operations and layoffs) and the net cost after asset sales and tax benefits has declined to an estimated $6-7bn.

Given Google’s timeframe for Motorola’s hardware product cycle revamp (12-18 months), it is reasonable to expect Google to launch its own high end Smartphones and tablets in Q4-2013, in time for the holidays. If Google can generate the same interest in its Motorola hardware products as it has for recent Nexus products, the product launches could be a catalyst.

WhiteBox Mobile Manufacturers Focus on Quality & Sub $200 Models

Many are still under the impression that whitebox market smartphone are of low quality and are barely usable. The business have started to change their mentality and focus more on quality. During our multiple trips to China in the past 6 months, we’ve witnessed a huge improvement in whitebox smartphone quality. With better economy of scale, prices also have come down very rapidly.

Many are still under the impression that whitebox market smartphone are of low quality and are barely usable. The business have started to change their mentality and focus more on quality. During our multiple trips to China in the past 6 months, we’ve witnessed a huge improvement in whitebox smartphone quality. With better economy of scale, prices also have come down very rapidly.

Most consumers are willing to pay a premium for branded products over Chinese brand / whitebox smartphone, especially in the mid to high end segment. However, we believe that in the sub US $200 segment, whitebox makers can offer similar form factor design but much better hardware specifications at lower prices. As such, it’s extremely difficult for branded players to compete with whitebox makers.

Acer Liquid E1, Z2, C1 Affordable Android SmartPhones

Acer has kicked off 2013 smartphone line-up with three new smartphones including Liquid E1, Z2, and C1. The detailed hardware specifications are still emerging. Initial feedback on pricing is interesting, in our view. It is reported the E1 will have a retail price for €199-299 and the Z2 for €99-129, suggesting Acer is attacking the … Read more