Amazon’s strategy, with ever-shorter delivery options, has allowed a pure eCommerce player to gain a foothold in Local commerce and an increasingly bigger share of consumers’ wallets. But while Amazon has always been and will remain retailers’ top competitor in many product categories – especially in consumer products – some of these retailers could actually benefit from the company’s growing fulfillment capabilities. Today, Amazon remains the clear leader in fulfillment, based on number of offerings, global fulfillment center footprint, and ability to manage demand elasticity through its digital assets.

Amazon’s strategy, with ever-shorter delivery options, has allowed a pure eCommerce player to gain a foothold in Local commerce and an increasingly bigger share of consumers’ wallets. But while Amazon has always been and will remain retailers’ top competitor in many product categories – especially in consumer products – some of these retailers could actually benefit from the company’s growing fulfillment capabilities. Today, Amazon remains the clear leader in fulfillment, based on number of offerings, global fulfillment center footprint, and ability to manage demand elasticity through its digital assets.

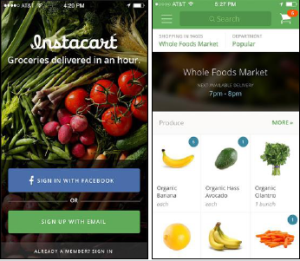

Today, however, services such as Google Express, Postmates, or Instacart and new fulfillment models based on real-time driver networks such as Uber, Lyft, and