Just Dial’s Search maintained a strong growth trajectory: searches were up 33% yoy in 1QFY16 with strong growth across business segments. Tier-II/III cities are growing at a very fast pace, supporting 20% growth for the top-5 cities. Steady growth in paid campaigns (ended at 346,000 in 1QFY16 in 15.3 mn listings) and steady pricing helped Just Dial sustain a 25% revenue growth in FY2015. Churn rate remains unchanged at 44% levels given high mortality and shift rate. Just Dial shared internet penetration limiting growth for the search business.

Just Dial’s Search maintained a strong growth trajectory: searches were up 33% yoy in 1QFY16 with strong growth across business segments. Tier-II/III cities are growing at a very fast pace, supporting 20% growth for the top-5 cities. Steady growth in paid campaigns (ended at 346,000 in 1QFY16 in 15.3 mn listings) and steady pricing helped Just Dial sustain a 25% revenue growth in FY2015. Churn rate remains unchanged at 44% levels given high mortality and shift rate. Just Dial shared internet penetration limiting growth for the search business.

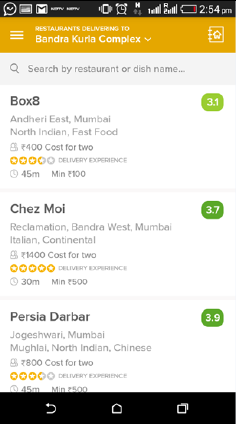

Just Dial aims to launch master app by September 2015 and is investing in back-end infrastructure in order to enhance