Major internet companies still generate significant revenues from advertising models. As the softening macroeconomic environment continues to affect overall ad budget sentiment, internet companies are embracing opportunities and challenges by adapting to changing dynamics.

Specifically, 2016 has been challenging for search advertising post the Zexi Wei incident in April and stepped-up regulatory policy on

social-media-advertising

Facebook’s Advertising & Video Platform – The RoadMap

Facebook appears to continue to have strong momentum in its core business, has significant new opportunities in areas like video and payments, is beginning to commercialize other apps.

Facebook appears to continue to have strong momentum in its core business, has significant new opportunities in areas like video and payments, is beginning to commercialize other apps.

Facebook made several important announcements related to its Video initiatives, including i) it is upping the maximum video upload file size to 1.5G, which is enough to support video as long as 45 minutes (i.e., its first foray into longer form video content); ii) it is rolling out an embedded video player for third-party apps and sites, which increases the reach of videos off-network, provides new solutions to publishers/apps, and represents a new competitor to YouTube; iii) announced the availability of spherical videos on the News Feed; and iv) suggested that pre- and/or post-roll ads in videos could soon be available.

Facebook highlighted three key data points of its Video Platform: 1) 3bn videos per day, of which a low percentage are

Mobile Social Platforms – Instagram & WhatsApp to be Monetized by Facebook

Instagram and WhatsApp’s large user base and high engagement levels suggest a large revenue potential for Facebook (FB).

Instagram and WhatsApp’s large user base and high engagement levels suggest a large revenue potential for Facebook (FB).

Instagram is a mobile online photo sharing, video-sharing social network service that allows users to take photos and videos and share them on its platform. Given growing use of photo sharing, we see Instagram as a well-positioned as a social and mobile platform play, and a nice compliment to the Facebook audience given a younger demographic profile of the site.

Instagram has exceeded with 300mn MAUs expectations. Site activity is impressive with 70mn photos shared per day and 2.5bn daily likes. Globally, users spend over 20 minutes per day on Instagram, which sets the foundation for material advertising dollars. We see a $4bn+ revenue opportunity and potential valuation range for Instagram at $30bn – $37bn based on user and potential revenue comparisons to

Google’s Video / Display Advertising Metric & Road Ahead

Google’s VP of Display and Video Advertising Products, Neal Mohan highlighted brand advertising as a growth opportunity for Google and YouTube as the centerpiece of that effort.

Google’s VP of Display and Video Advertising Products, Neal Mohan highlighted brand advertising as a growth opportunity for Google and YouTube as the centerpiece of that effort.

Mohan provided new metrics about YouTube, including: 1) it attracts over one billion users per month, 2) the amount of watch-time is growing 50% y/y, 3) the innovative TrueView skippable ad unit on YouTube is growing impressions nearly 75% y/y, 4) YouTube has more 18-34 year-olds than any cable channel, 5) YouTube payouts (rev share) to content creators grew by ~50% y/y in 2014, and 6) that there was over seven million hours of ad content on YouTube and last year four of the top 10 most viewed videos on YouTube were ads created by brands/their agencies. These data points

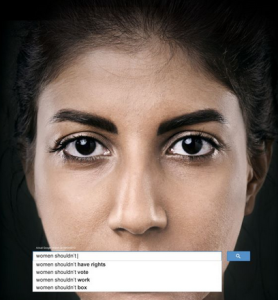

Impact of Internet Advertising on Agencies / Other Industries

We previously discussed on How Internet Advertising has Disrupted Traditional Marketing channels such as Paper / TV / Radio. Today, we’ll highlight the impact of Digital A&M on Agencies and other industries.

We previously discussed on How Internet Advertising has Disrupted Traditional Marketing channels such as Paper / TV / Radio. Today, we’ll highlight the impact of Digital A&M on Agencies and other industries.

Impact on Media Owners

The move to online significantly lowers the barriers of entry for new potential competitors. Clearly, the most famous examples involve exciting tech-based start-ups — the Google’s, Facebook’s, Netflix’s of this world. We would also argue that the move by selected larger media conglomerates to own media channels in international markets (e.g. Discovery with Eurosport/SBS) is also perhaps a symptom of the same trend.

This is not a challenge for 100% ad funded media companies, but it is for those media companies that enjoy a dual stream of monetization in an analogue world, (e.g. print newspapers/magazines). For example, a regional newspaper may be able to defend a regional classified model online – this has

How Digital Advertising & Marketing Disrupted Print / TV & Set to Overtake Offline Budgets ?

As the Internet goes mainstream and customers spend more and more time online, marketing dollars continue to migrate to digital channels. This trend is not new and from the earliest days of the commercial Internet, unsophisticated banner ads and then search advertising gained traction and turned into large markets. Over time, Internet Advertising began to cannibalize offline marketing spend in areas such as print, radio, TV and other mediums, although offline marketing continues to dominate the marketing budget and digital channels make up well less than 50% of marketing and advertising spend.

As the Internet goes mainstream and customers spend more and more time online, marketing dollars continue to migrate to digital channels. This trend is not new and from the earliest days of the commercial Internet, unsophisticated banner ads and then search advertising gained traction and turned into large markets. Over time, Internet Advertising began to cannibalize offline marketing spend in areas such as print, radio, TV and other mediums, although offline marketing continues to dominate the marketing budget and digital channels make up well less than 50% of marketing and advertising spend.

As we look forward, we see a landscape that will ultimately drive digital marketing to be the primary channel, indeed in some countries in Europe and Asia, this is already the case where various

Google’s Internet Advertising Model Under Pressure ?

Google the Search giant was the first company to meaningfully monetize the Advertising model across the spectrum of the Web from Large to the Smallest Publishing Networks. As other forms of web have emerged like Mobile Apps, Facebook, Twitter, etc the Ad Dollars are increasingly shifting to places where there is consumer engagement model.

Google the Search giant was the first company to meaningfully monetize the Advertising model across the spectrum of the Web from Large to the Smallest Publishing Networks. As other forms of web have emerged like Mobile Apps, Facebook, Twitter, etc the Ad Dollars are increasingly shifting to places where there is consumer engagement model.

In the latest quarterly results of Google, the number of aggregate paid clicks, or the total number of times a user clicks on an ad, increased 26% on a yoy basis in 1Q14. This compares with 31% yoy growth in 4Q13 and 20% yoy growth in the year ago period. On a sequential basis, paid clicks declined 1% which is below an average increase of 5% qoq over the prior three March quarters. CPCs declined 9% yoy during the period and were flat qoq (FX had a minimal impact on CPC growth). As management has stated previously, CPCs (and overall click trends for that matter) are affected

Future of Digital Advertising – Internet, Mobile & Video

The past decade has seen significant migration of advertising dollars from traditional media like TV and newspapers to digital channels like internet and mobile devices.

The past decade has seen significant migration of advertising dollars from traditional media like TV and newspapers to digital channels like internet and mobile devices.

Mobile Advertising

Mobile devices – smartphones and tablets – are changing the consumption pattern of various publishing platforms and content. User engagement on mobile devices is significantly better than on the desktop given the 24×7 availability of mobile communication amongst other things. The best examples of this shift are Facebook and Twitter, where engagement and monetisation have significantly moved to the mobile format. On a worldwide basis, mobile advertising still represents less than 2% of total advertising spends and around 8% of total spends on digital media. As brought out by examples of Facebook and Twitter, it is imperative for other platforms to build their mobile presence more extensively in terms of apps and otherwise, which in turn

What is SingTel’s Group Digital Life About ?

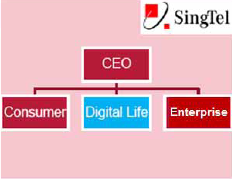

Asia Pacific Telecommunications giant which grew its business by investing substantial amount in companies like Airtel, Optus etc announced a new organization structure in March 2012 across product groups, rather than geographies, and also created a new business under Mr Allen Lew called Group Digital L!fe (GDL). Digital Life is one of the core Businesses Group.

Asia Pacific Telecommunications giant which grew its business by investing substantial amount in companies like Airtel, Optus etc announced a new organization structure in March 2012 across product groups, rather than geographies, and also created a new business under Mr Allen Lew called Group Digital L!fe (GDL). Digital Life is one of the core Businesses Group.

This isn’t a well understood business and there is generally a broader skepticism. Consumers now look to their mobile devices for immersive content, entertainment and commerce. Group Digital L!fe is

Mobile Advertising – Apple Devices Command Ad Premium over Android

The most important and fastest growing segment of Internet advertising is mobile advertising, which makes tracking the underlying key drivers and trends of great importance. Mobile eCPMs increased 68% y/y in 3Q13 and 9% sequentially despite what is typically a seasonal slowdown in Q3 (note that MoPub’s data showed a 10% seq. decline in 3Q12). A key driver of this price increase, in MoPub’s opinion, is the increase in the number of competitive bidders in the auction.