Major internet companies still generate significant revenues from advertising models. As the softening macroeconomic environment continues to affect overall ad budget sentiment, internet companies are embracing opportunities and challenges by adapting to changing dynamics.

Specifically, 2016 has been challenging for search advertising post the Zexi Wei incident in April and stepped-up regulatory policy on

Web 2.0

Amazon Indian eCommerce + Video/Music Content attract Investments

Amazon is accelerating its investment in its retail operations in India. For one, two years after committing $2bn, this Mr. Bezos announced that he was committing an additional $3bn in India. We believe this was likely due not only to the success that Amazon has been seeing and the significant opportunity that it still sees ahead, but may also have been due to the need to continue to investment its logistics in order to address infrastructure issues in India, to take advantage of potential challenges at local competitor Flipkart, and to address new regulations taking hold in India.

Amazon is accelerating its investment in its retail operations in India. For one, two years after committing $2bn, this Mr. Bezos announced that he was committing an additional $3bn in India. We believe this was likely due not only to the success that Amazon has been seeing and the significant opportunity that it still sees ahead, but may also have been due to the need to continue to investment its logistics in order to address infrastructure issues in India, to take advantage of potential challenges at local competitor Flipkart, and to address new regulations taking hold in India.

The Executive Management’s commentary on the 2Q16 earnings call that it plans to double video content investment in 2H16 likely points to acceleration in spend this year vs. 2015. Moreover,

How Amazon’s Competitors Rank on Last Mile Delivery ?

Amazon’s strategy, with ever-shorter delivery options, has allowed a pure eCommerce player to gain a foothold in Local commerce and an increasingly bigger share of consumers’ wallets. But while Amazon has always been and will remain retailers’ top competitor in many product categories – especially in consumer products – some of these retailers could actually benefit from the company’s growing fulfillment capabilities. Today, Amazon remains the clear leader in fulfillment, based on number of offerings, global fulfillment center footprint, and ability to manage demand elasticity through its digital assets.

Amazon’s strategy, with ever-shorter delivery options, has allowed a pure eCommerce player to gain a foothold in Local commerce and an increasingly bigger share of consumers’ wallets. But while Amazon has always been and will remain retailers’ top competitor in many product categories – especially in consumer products – some of these retailers could actually benefit from the company’s growing fulfillment capabilities. Today, Amazon remains the clear leader in fulfillment, based on number of offerings, global fulfillment center footprint, and ability to manage demand elasticity through its digital assets.

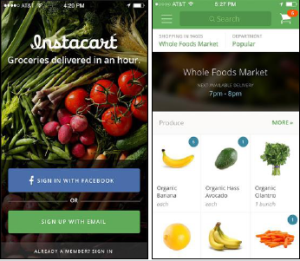

Today, however, services such as Google Express, Postmates, or Instacart and new fulfillment models based on real-time driver networks such as Uber, Lyft, and

Facebook at Work to Compete Slack’s Growth

Technologies and applications first developed for the consumer Internet space have had an important impact on enterprise environments, and consumer Internet companies, such as Google and Amazon, have benefited from their enterprise efforts in areas like productivity apps and cloud services. Leveraging its strengths in app development, messaging, and social networking, Facebook is expected to launch its Facebook at Work solution for general availability as early as next month.

Technologies and applications first developed for the consumer Internet space have had an important impact on enterprise environments, and consumer Internet companies, such as Google and Amazon, have benefited from their enterprise efforts in areas like productivity apps and cloud services. Leveraging its strengths in app development, messaging, and social networking, Facebook is expected to launch its Facebook at Work solution for general availability as early as next month.

Slack the network for

Why Google Cloud acquired Apigee API Platform ?

Google Cloud Platform business unit acquired Apigee, a provider of application programming interface. Apigee provides an API platform that can be used by companies to make their services available on multiple mobile devices. Apigee also provides its customers analytics to measure the activity coming from the apps. As an example, Walgreens uses Apigee to manage the Walgreens APIs that developers use to build apps for the Walgreens ecosystem.

Google Cloud Platform business unit acquired Apigee, a provider of application programming interface. Apigee provides an API platform that can be used by companies to make their services available on multiple mobile devices. Apigee also provides its customers analytics to measure the activity coming from the apps. As an example, Walgreens uses Apigee to manage the Walgreens APIs that developers use to build apps for the Walgreens ecosystem.

This enhances Google’s push into corporate computing as they look to take advantage of the evolving industry dynamics. Google’s head of cloud computing Diane Greene stated as follows

How Big 3 Cloud Computing Platforms – AWS / Azure / Google are Stacked Up Against each Other ?

Every industry / vertical has Big 3 companies like we have seen in the past from Automobiles to Software. When it comes to offering Cloud platform, Amazon leads the pack with AWS, Microsoft’s Azure is a distant second and Google is the clear #3. Time to Market and Investments helped Amazon launch Amazon Web Services in 2006 versus Azure and Google Cloud Platform coming on in 2010 and 2013 and Microsoft having since committed more heavily in the space than Google.

Every industry / vertical has Big 3 companies like we have seen in the past from Automobiles to Software. When it comes to offering Cloud platform, Amazon leads the pack with AWS, Microsoft’s Azure is a distant second and Google is the clear #3. Time to Market and Investments helped Amazon launch Amazon Web Services in 2006 versus Azure and Google Cloud Platform coming on in 2010 and 2013 and Microsoft having since committed more heavily in the space than Google.

The path each company took is different as each player has borrowed from heritage and experience earned from their principal operations to establish their position in the cloud computing landscape. AWS is leveraging its massive scale and commitment

VC / PE Investors Strategic Look for Funding Startups

Tighter funding has led to exits, consolidation and focus on unit economics. However, those backed by strategic Investors / subsidiaries of overseas players appear better placed. Recent call with a leading private investor highlighted that GMV growth for ecommerce players will be under pressure in the near-term. This is being driven by limitations on marketplaces by new regulations to become compliant with 25% threshold sale limit from single vendor and reducing heavy discounts that were driving significant growth.

Tighter funding has led to exits, consolidation and focus on unit economics. However, those backed by strategic Investors / subsidiaries of overseas players appear better placed. Recent call with a leading private investor highlighted that GMV growth for ecommerce players will be under pressure in the near-term. This is being driven by limitations on marketplaces by new regulations to become compliant with 25% threshold sale limit from single vendor and reducing heavy discounts that were driving significant growth.

Management commentary of Amazon, Rocket Internet and Softbank over last 15 mths highlights diverging thinking even between strategic investors. Amazon/Softbank talk about market potential and plans for continued investing. Rocket Internet (for Jabong) has moved from market share to balancing growth/profitability to profitability now. In fact,

Local eCommerce – Lessons for JustDial / Entrepreneurs from Baidu Local Express

Chinese Internet Giant, Baidu has had Keyword based bidding on the lines of Google AdWords for sometime codenamed as Phoenix which Local service platforms still find the bidding system complicated. In October 2015, Baidu launched Local Express, a new simpler marketing platform for local merchants. Its key advantages include:

Chinese Internet Giant, Baidu has had Keyword based bidding on the lines of Google AdWords for sometime codenamed as Phoenix which Local service platforms still find the bidding system complicated. In October 2015, Baidu launched Local Express, a new simpler marketing platform for local merchants. Its key advantages include:

- Ease of use of the marketing interface, without the hassles of choosing keyword price.

- Geo-targeting to customers within 5-30 km from merchants, making the marketing campaign more effective

- One-stop ad placement displaying across three key traffic platforms on Baidu: Baidu Mobile, Baidu Map, and Nuomi apps. In the past, Baidu search and Baidu Nuomi had separate marketing and services channels

- Infrastructure support. Merchants can rely on Baidu Nuomi’s landing page support, and do need to set up their own website.

Local Express currently targets eight local service sectors, including (1) cosmetics, nail polishing, manicure, and pedicure, (2) gym and yoga, (3) talent training, (4) electronics repair, (5) auto services, (6) photography, (7) moving and housekeeping services, and (8) plumbing services. These are also existing categories on Nuomi’s platform. We note that restaurants, KTV, and tourism, are not

Jabong Bid Adieu to Aggressive Discounting, Path to Profitability

The drastic QoQ improvement in Jabong.Com gross margins (900bps) implies that GMV (gross merchandise value) per transaction has improved by 22% to the highest ever even as revenues fell by 8% QoQ. Our reading is that cash-strapped or undingconstrained portals could witness reduction in revenues as they look to monetise the existing customer base with the convenience of range and shipping over pricing.

The drastic QoQ improvement in Jabong.Com gross margins (900bps) implies that GMV (gross merchandise value) per transaction has improved by 22% to the highest ever even as revenues fell by 8% QoQ. Our reading is that cash-strapped or undingconstrained portals could witness reduction in revenues as they look to monetise the existing customer base with the convenience of range and shipping over pricing.

Jabong’s gross margins (500bps improvement in CY15) seem to indicate that discounting has reduced but operating margin of -49% in CY15 clearly indicates high customer acquisition and retention costs. While discounting on own inventory

Indian Internet Companies Revenues Soar, Losses Mount

Analysis of recently reported 2015 financials of 22 unlisted e-commerce companies reveals some interesting trends: (1) these companies posted revenue growth of 191% yoy, with marketplaces leading the pack at 475% revenue growth (not GMV), (2) in most other categories (barring marketplaces), loss was magnified by high cash-burns from 1-2 players (for instance, housing.com in real estate). Several companies (general + real estate classified companies in particular) spent aggressively on advertising to gain traffic and market-share.

Analysis of recently reported 2015 financials of 22 unlisted e-commerce companies reveals some interesting trends: (1) these companies posted revenue growth of 191% yoy, with marketplaces leading the pack at 475% revenue growth (not GMV), (2) in most other categories (barring marketplaces), loss was magnified by high cash-burns from 1-2 players (for instance, housing.com in real estate). Several companies (general + real estate classified companies in particular) spent aggressively on advertising to gain traffic and market-share.

e-tailers is the only category where loss margin declined yoy (though loss in